In the current era marked by global connectivity and rapid technological evolution, the payments landscape is undergoing a deep and important transformation. At the centre of this transformation is the rise of Instant Payments Systems (IPS), which represent a fundamental shift in policy, regulations, technical capabilities, and commercial models. Instant Payment Systems have been adopted in over 40 countries1 and provide low-cost, convenient, and secure payment services to a wide array of customers of various financial institutions. Approximately 85% of banks2 worldwide acknowledge IPS as a foundational element for future growth and product enhancements.

The Central Bank of the United Arab Emirates is actively pursuing digital innovation through the Financial Infrastructure Transformation (FIT) Programme. Among other key objectives, the FIT Programme focusses on driving financial inclusion, promoting payment innovation, enhancing security and efficiency, and reducing the cost of payments. There are nine key components designed to expedite digital transformation across the UAE's financial services sector, including the launch of a domestic card scheme, the Aani Instant Payments Platform, introducing open finance, and the issuance of a central bank digital currency. As an integral part of the FIT Programme, a new national payments company called Al Etihad Payments (AEP) was established in 2023 as the operator of financial payments market infrastructure in the UAE. AEP’s scope includes the forthcoming domestic card scheme, open finance services, and the Aani IPS, which was launched in October 2023 with 10 participants.

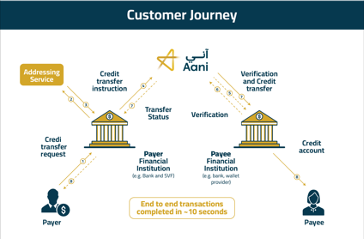

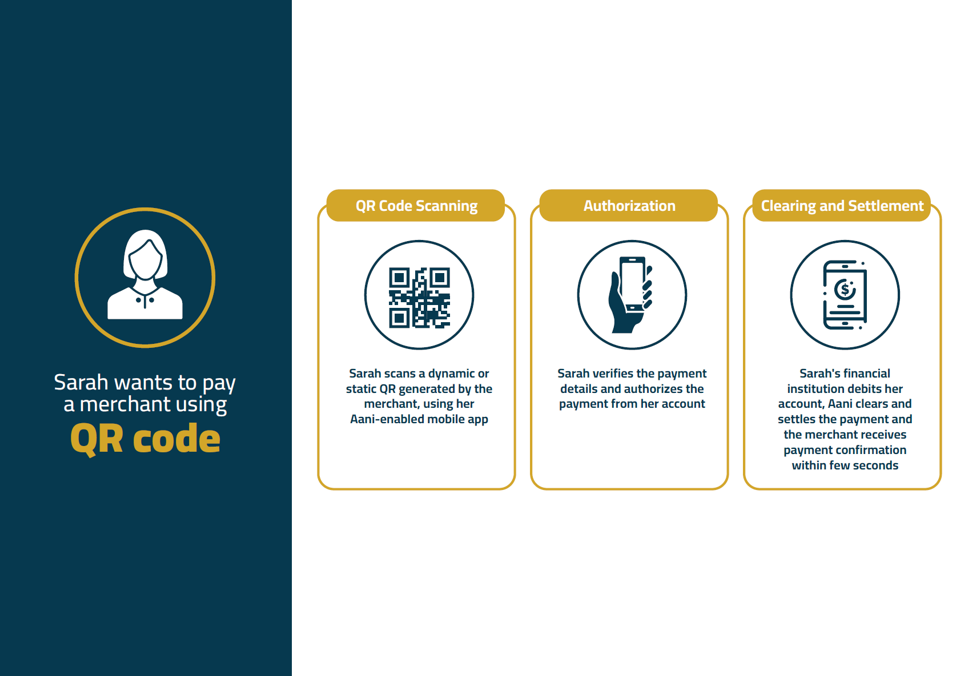

The Aani platform caters to consumers, businesses, corporate entities, and governments, allowing them to process transactions instantly and securely, 24/7. As an open loop payment system, Aani simplifies the payment process by using only the recipient's mobile number, email, or a QR code, thus eliminating the need to ask for or remember complex IBANs. Importantly, Aani services are available via participating financial institutions’ own apps or through the Aani iOS/Android app, allowing users to connect and transact from their accounts at various financial institutions in one mobile app.

Aani's user-centric design and simplified transaction processes cater to a diverse range of users, including those who may not have traditionally engaged in digital financial services. Any payment account, including licensed wallets and, for some use cases, the UAE’s Wage Protection System (WPS) “salary” cards can be used to originate Aani transactions.

For individuals, Aani's inclusive features empower users by providing a seamless and user-friendly platform, encouraging even those with limited exposure to digital transactions to participate. The commitment to conducting transactions up to AED 50,000 instantly and conveniently, 24/7, enhances financial flexibility for users, breaking down barriers to financial access.

For businesses, Aani's collaboration strategy with licensed financial institutions and payment service providers contributes to financial inclusion by expanding the reach of the platform. Through these partnerships, Aani ensures that businesses, regardless of size, can easily integrate the platform into their financial operations, fostering a more inclusive financial ecosystem.

In addition to Send Money features, Aani’s Request Money capability allows users to effortlessly request funds from their contacts or for merchant payments, and to request payment from customers in physical stores or online.

Lastly, Aani QR codes for point-of-sale transactions expand the universe of payment options for merchants, particularly those who may not be able to (or haven’t wanted to) accept card payments. Aani QR codes scanned with the customer’s banking app or the Aani app are a convenient and low-cost alternative for merchants to receive funds in real time.

At the core of Aani's design philosophy lies the adoption of the ISO 20022 messaging standard. This globally recognized standard for financial messaging ensures a common language for diverse financial transactions, enhancing interoperability and facilitating smoother communication between financial entities. Aani's event-driven data architecture further enhances operational efficiency and lays the groundwork for industrialized analytics and reporting. With a dedicated focus on risk management and financial risk controls, Aani introduces a nuanced approach to transaction settlement exposure limits, ensuring participants benefit from a precise and transparent settlement process. With real-time settlement for every single transaction (on a gross basis) against a prefunded amount, Aani provides financial entities with granular control over their exposure, optimizing intra-day credit, liquidity positions, and operational risk controls.

Aani's implementation strategy unfolds over three distinct phases. These phases encompass (1) the core instant payment services, (2) the Electronic Direct Debit Authorization (eDDA) capabilities, and (3) the introduction of Electronic Cheques (eCheques). This phased approach reduces implementation risk and ensures that participants are able to assimilate changes without significant disruption. Each wave is accompanied by support and training resources, facilitating a smooth transition for the ecosystem.

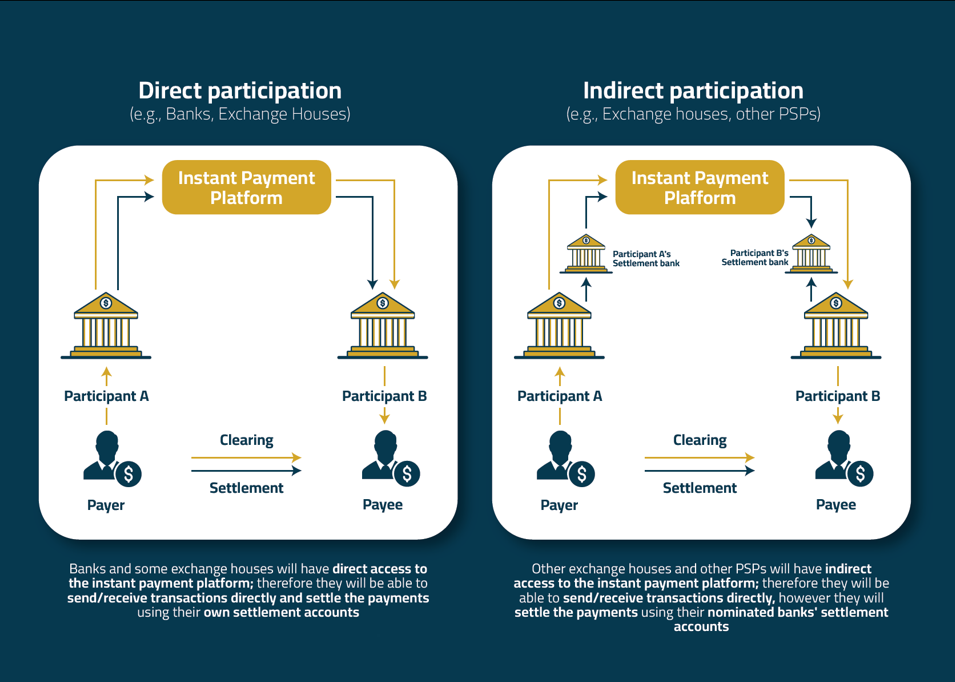

From a system access perspective, the Aani participant ecosystem includes a diverse group of financial institutions, each operating uniquely. As such, the platform offers both direct and indirect models to settle Aani transactions. This direct access model allows for sending and receiving of transactions, and settling payments using dedicated accounts within the Aani infrastructure. Conversely, the indirect participation mode accommodates a broader spectrum of financial entities, including other exchange houses, Payments Service Providers (PSPs), and Stored Value Facility (SVF) and Retail Payment Services (RPS) who settle transactions via a sponsoring settlement bank. These entities still interact with the Aani platform directly, sending and receiving payments directly but settling those transactions through the accounts of their designated settlement banks. This approach ensures flexibility, allowing a wider range of financial service providers to benefit from Aani while utilizing existing banking relationships for settlements.

Aani's participation models respond to the diverse roles and licensing structures within the UAE financial sector. This inclusive design accommodates the varying needs of banks, exchange houses, and all other PSPs, acknowledging that a one-size-fits-all solution is neither practical nor conducive to fostering a thriving financial ecosystem. By providing direct and indirect participation models, Aani ensures that its benefits extend across the financial spectrum. Aani not only catalyzes the adoption of instant payments but also contributes to the broader vision of the UAE as a financial and digital payment hub, embracing innovation and efficiency across the entire financial landscape.

From a technology perspective, Aani has implemented a scalable and flexible infrastructure to accommodate increased user adoption over time. The platform's modular architecture is designed to scale horizontally, allowing for the addition of new resources and servers to handle growing transaction volumes. The platform places a strong emphasis on regulatory compliance and the protection of user data. Robust measures are in place to ensure the security and integrity of the platform, aligning with strict international and local regulatory standards as guided by the Central Bank of the UAE.

Additionally, Aani has implemented comprehensive data protection policies, outlining strict guidelines for the collection, storage, and usage of user data. These policies align with global data protection standards, ensuring that user privacy is a high priority. Continuous monitoring, regular security updates, and proactive measures against emerging threats contribute to maintaining a secure and compliant environment within the Aani platform. By prioritizing regulatory compliance and data protection, Aani aims to instil confidence in users, fostering trust and long-term relationships in the digital financial landscape.

As Aani takes centre stage in the UAE's financial transformation, the product roadmap aims to continually enhance system capabilities while improving the scale and reach of the platform. The primary focus in 2024 is to onboard over 50 more licensed financial institutions (LFIs) as well as tens of thousands of merchants to accept Aani payments. Aani's collaboration strategy with LFIs revolves around fostering partnerships that enhance its reach and user base. AEP actively engages in partnerships with all LFIs, offering them the opportunity to integrate Aani into their service offerings. This collaboration benefits both parties: LFIs can provide their customers with access to Aani's innovative payment solutions, while Aani expands its user base through these established financial entities, as well as merchant acquirers.

AEP will also regularly review and potentially increase the current limit of AED 50,000 to accommodate larger transactions. The limit increases would take place in a phased approach, as has happened in other jurisdictions that have implemented real-time payments.

AEP is also exploring connectivity with these platforms, which aligns with the UAE’s global vision of enhancing cross-border transactions and international remittances. AEP is actively exploring international collaborations and partnerships with instant payment platforms in other countries. These partnerships aim to establish interoperability, allowing users on Aani to seamlessly conduct cross-border transactions and international remittances with users on partnered platforms.

In summary, Aani plays a crucial role in the ongoing transformation of the UAE's financial landscape. Through its user-friendly design and inclusive features, Aani facilitates instant, secure, and convenient transactions for individuals, businesses, corporate entities, and governments around the clock. By simplifying payment processes with innovative methods such as QR codes and inclusive participation models, Aani promotes financial inclusion and eliminates traditional barriers. As the platform evolves and broadens its user base, it not only aligns with the UAE's vision as a financial and digital payment hub but also contributes to the global conversation on the future of financial transactions. Aani's dedication to regulatory compliance, data protection, and continuous improvement positions it as a reliable and central player in the digital financial landscape, highlighting its importance in the ongoing financial transformation of the UAE.